The Federal reserve voted to begin a third major asset purchase program at their September meeting.

Under the new plan, the Fed will create reserves to purchase 40bn of MBS each month – until ‘the outlook for the labour market improves substantially’. The IOER rate was left at 25bps, and the low rate pledge was moved out from ‘late-2014’ to ‘mid-2015’. There was no new UST buying announced, though the Fed will complete ‘twist2’ as announced.

This means 85bn per month of buying — 45bn per month of long end buying due to twist2, and 40bn per month of balance sheet expansion via MBS purchases. This program is more potent than QE2, as it involves the Fed taking more ‘risk’ – as it is purchasing MBS.

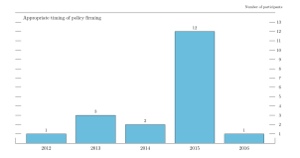

Even with this additional easing, the vast majority of Governors do not expect the fed’s policy rate to rise until 2015. To better demonstrate their reaction function, the statement added:

the committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens

This is the most ‘Woodfordian’ part of the new policy – the FOMC is trying to make plain that they will not be tightening until the recovery is well advanced.

I am becoming more pessimistic myself, but the company is getting scarce – only one voter still expects the policy rate to be unchanged by the end of 2015. What is more interesting (and unrealistic to me) is that the median of voter appear to believe that the neutral policy rate in the long run is ~4%. I would guess that this is a ‘golden rule’ type 2% + 2% argument.

Perhaps, over the very long run this will hold once again, however over the next decade or so, I think it likely that the US economy would feel the pinch if they got much above 2%

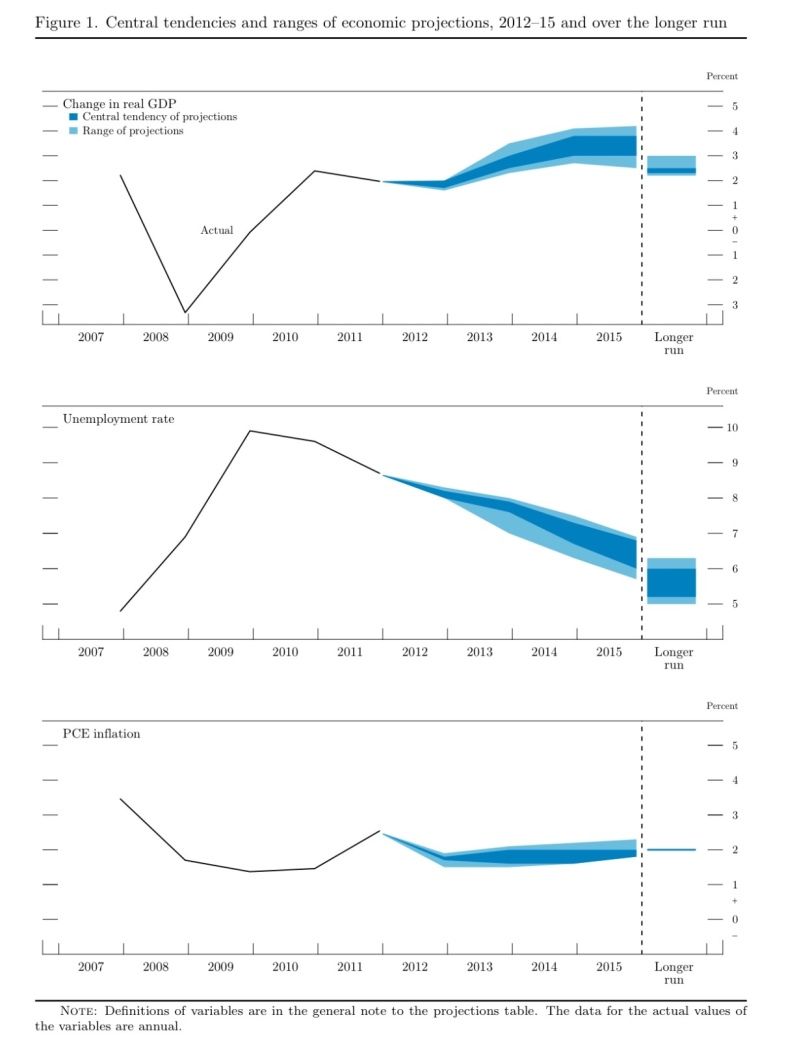

To my eye, their forecasts still look too optimistic on growth and the unemployment rate – but i guess it is hard to be sure how long this policy is going to run for – or indeed if any of the individual forecasts assume more QE!

Remember that each forecast is made assuming ‘appropriate monetary policy’, and that statement is broad enough to cover a multitude of sins…

Some encouragement there for NGDP targeters, but it may already be too late for this cycle – according to both Sumner and the ECRI. The problem they have created by leaving it this late is that ‘unlimited QE’ gets blamed for the recession that potentially began in Q2.

Rajat,

if the US lurches back into recession QE SHOULD wear some of the blame.

QE robs the private sector of income. Banks & financial institutions sell 2-6% yielding assets in return for cash returning 0.25%. This is a loss to the private sector – effectively a tax. And increasing taxes is not what is needed for the US economy right now.

Why would the sell if they thought they could do better by holding? Isn’t the point to push up prices so that they find willing sellers. The sellers capitalize more than their expected returns by selling to the fed, and get a risk free deposit. What they do next depends …

Why would the sell if they thought they could do better by holding?

—

Short term rise in asset prices does nothing for the real economy. Surely we learnt that from 1929, 1986, 1999 an 2006? Surely it is the real economy that matters?

What happens next? Bank earnings downgrades because of lost net interest income. banks foreced to retrench staff, limit credit causing rising unemployment.

Do you think the Fed will make or lose money from this operation?

I think this is true up to a point. Selling assets and not replacing them, if that is what occurs, allows banks to capitalize future profits and if they do so they will require less staff and other resources (they will require less monitoring capacity etc).

New business may or may not be more profitable as a result – that depends on what ails us.

So let me get this straight…

Freddy and Fanny funded +80% of mortgages and that was a bad thing…

So in order to get the US economy to recover, we will just have the Fed buy MBS…quantity unknown…

Yep, I do not get this either. Let’s just sell all the crappy loans to the Fed. How about next time you prevent the real estate bubble from forming in the first place? What most annoys me is that the usual suspects will benefit from all of this liquidity, yet again, and it’s not going to be the American people.

Totally agree. Monetary policy is not free – it is strongly redistributive.

The US government has already guaranteed agency MBS hasn’t it? So why shouldn’t the Fed buy them at market prices?

David Eagle has argued that NGDP targeting pareto dominates inflation and price-level targeting. The basic point seems to be:

ssec,

I would have no problem if they were sold crappy loans and they go bad. If the Fed loses money on QE then the private sector has made a gain. This would actually count as stimulus.

Where I think the problem lies is the Fed will collect net interest income from these operations – at the expense of the private sector. Effectively a tax.

Assuming US$1.0T of QE at an interest rate spread of 4% = $40bn of lost income to the provate sector per annum. Add the Fiscal cliff and the US economy now has serious headwinds.

So, let’s say a home owner in the US wants to refinance, or an investor wants to buy an investment property…. the loan can be re-packaged and be sold to the fed anyway (now or if things go wrong later on, in exchange for new printed money: that’s different from being guaranteed by government finances). So who will *properly* evaluate the risk behind making that loan. Wasn’t that exactly what caused the whole GFC debacle in the first place? When there’s no risk, money is not properly allocated.

Ever get the feeling that the role of policy is to put the bad investments back into the money? At times it seems that way…

touché

I never thought about it in that way, but that’s exactly what it is. Especially in the last few years.

Ricardo, going back to our earlier discussion, do you still think QE3 increases the pressure on the RBA to cut? I don’t think so, I think the reverse. Mind you, I still think they should cut.

Yep, i think AUD at 1.06 makes life difficult for a lot of sectors. I think 1.10 in Oct and they could do so despite equities being up large.

Ricardo, is this the last bullet? Is this it?

Will the US follow the same road as Japan?

Well, one thing for sure there is not going to be QE4 … QE3 might never end :)

They are not out of ammo – not even close. They could take still more risk, cut the IOER rate, raise their inflation target…

I think the next step is to get more explicit about their reaction function – probably via a single economic forecast with a proper fan chart. Then they could show that even if inflation is 2.5% and gdp 4% that they won’t tighten.

They are half way there just now, with the current format, and the words they have used.

OK! So if they are half way there… just now, does it mean that what’s left will be half as effective compared to what has been done already?

Saturday is the best of the seven days, full of hope and joy:

tomorrow the hours will bring anxiety and sadness,

and make each turn, in thought, to their accustomed toil.

:)