When it comes to the labour market survey, I mostly focus on the rates: the unemployment rate (see here for my wrap), and the gross flows rates (the probabilities of transitioning from one labour market state to another).

The gross flows data has some decent signs, and they suggest that there is a recovery in train. The labour market is stabilising if you have a job — however if you are unlucky enough to be unemployed, it remains tough to find work (this bit tends to pick up with a lag). Average hours worked remain low, both in terms of population and those who are in the labour force.

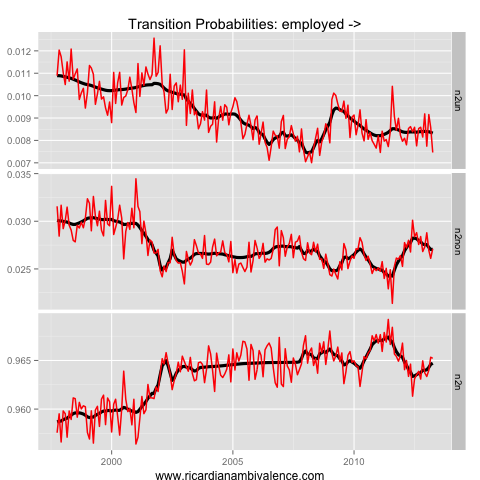

The probability of transitioning from employment to to unemployment fell a little in April, down ~10bps to ~75bps in seasonally adjusted terms, and stable at ~85bps in trend terms (so around 1% of folks lose their job and become unemployed each month). There’s a hint of things improving in trend terms, but it is not sure just yet. The probability of exiting the labour market from employment rose ~10bps to ~270bps, but looks to be on a downtrend.

The drop in transitions from employment to not-in-the-labour-force may reflect a decline in redundancies. Combining the two , the probability of retaining your job, if you have one, is stable at ~96.5%. There has been a trend improvement in this measure, reflecting the down trend in transitions from employment out of the labour market.

Life for the unemployed, however, is getting harder. If you are unemployed, the probability of transitioning to employment is a low 18.5% in seasonally adjusted terms (down 60bps on March, after falling ~75bps in February). There is a worrying downtrend in place here.

Consistent with this, folks are more likely to give up search (~25.5% in trend terms) — this is reflected in an uptrend in transitions from unemployment to not-in-the-labour-market.

Combining the two, the probability of remaining unemployed if you lose your job has been gradually trending up (it’s now ~55% in trend terms) – though it remains low compared to a decade ago.

The interesting action this cycle has mostly been in the not-in-the-labour-force dynamics. You can see this from the lower than usual probability of remaining out of the labour force if you have exited (~92%).

Entries and exits from this category have been moving around quite a bit. Earlier on, it had been the case that folks exited the labour force from employment and re-entered from not-in-the-labour-market, without first identifying as unemployed.

This trend is now reversing — potentially reflecting a weaker labour market. The probability of moving directly from outside the labour market into a job is now now ~4.7%, and is trending lower. Reflecting this, more folks are now transitioning back into the labour market via unemployment (now ~3% after falling to ~2.7% in the post GFC recovery).

All told, i get the sense from the gross flow data that folks are returning to the labour market to look for work. This may be for good reasons or bad reasons. The good reason would be if they have returned to search (unemployment) as expected returns to search have risen. The bad reason would be if they are looking for work as redundancy payments have running out, and their consumption is getting squeezed.

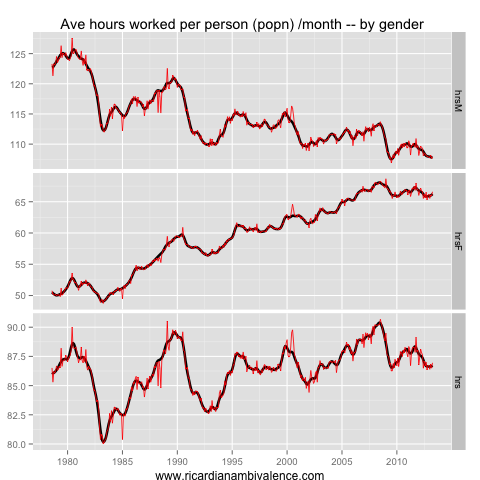

Any way you cut it, it’s clear that there is ample spare capacity in the labour market. Hours worked per employee are around cycle lows — though they are gently trending up.

After adjusting for population (to take out the participation rate noise) average hours worked per head of population is gently trending up (the bottom was Nov’12) but remains only ~0.2% above the GFC low.

Which ABS table are you using for this one? I’ve never seen these transition probabilities before.

The history is in the data cube. You need the annoying supertable to get it. I do the SA and trend from the NSA data the ABS provides.