The fact that Australian house prices are now back to 2016 levels (or below in some areas) means that there is a rising number of property transactions where the purchase price is now above the current valuation (or more importantly, the likely sale price).

This is feeding through into the RBMS sector, with a rising share of the mortgage pools that back recent issues now having very high LVRs.

The chart below is taken from some great work done by Coolabah Capital CIO Chris Joye. He and his team have re-valuated houses in RMBS pools and, after accounting for amortisation, find that the proportion of high LVR (> 90%) mortgages underlying recent RMBS issues has increased by 3x to 4x. Of the twenty RMBS they analyse, twelve of them now have a 90% LVR mortgage share in the teens — up from only one at the time of issue.

Of course, this is only a problem if folks stop repaying. However, that’s very likely for some. Regular (if tragic) life events such as loss of employment, sickness, or death, mean some people will always be unable to repay — and will have to sell to exit.

A high LVR and a soft property market, increases the probability of a loss being made at the point of exit.

So the equity protecting owners of RMBS is shrinking. Also, the softer housing market and economy means that pre-payment rates are slowing. So the RMBS are getting riskier.

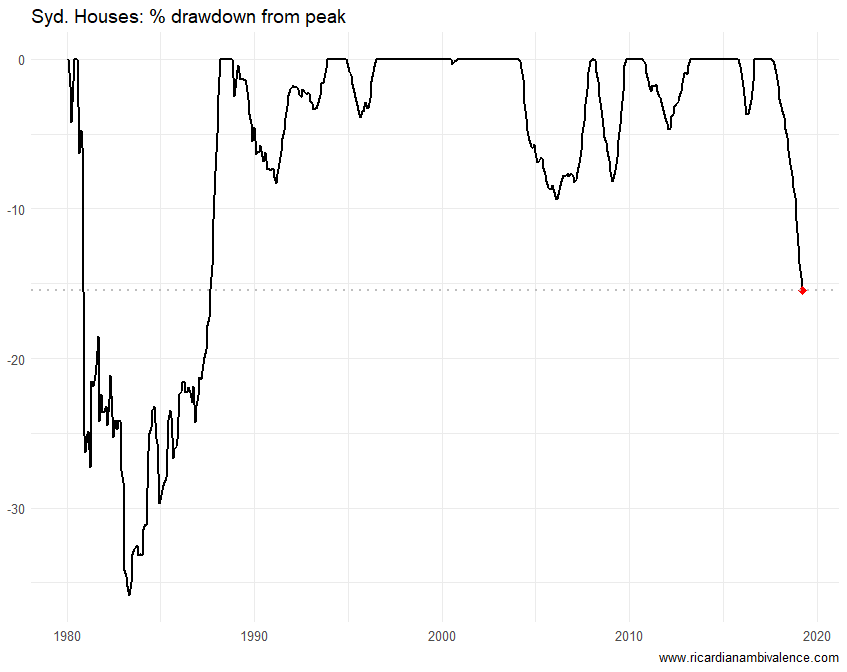

If property prices keep falling ~1% per month, the share of mortgages with LVRs greater than 100% will continue rising. Sydney seems to be most at risk just now. The draw-down from the top is ~15% for Houses; Sydney Units are down ~11%, however looming supply (and problems with settlement valuations coming in below contract prices) make another 10% down seem entirely plausible.

Coming back to RBMS, Chris notes that there is already one (recent) issue where over 10% of the mortgages are underwater.

Unless something is done to ease credit conditions, all of these RBMS will have meaningful proportions of the mortgage pool with LVRs that exceed 100%. Given the way that ASIC’s Shipton is talking, I would think that the only easing that’s possible in the near term will have to come from the RBA.

You might not have been around last time this occurred but some banks ignored whether people could pay back the loan and said simply the LVR was too high and put the property up for sale.

Have they learnt their lesson?

Fantastic to see so many articles. I am like a pig in mud reading them.

do tell? so they just went to the underlying home owner and put the house up for sale without their consent? How is the legal?

yep,

Memory is sketchy on how they did it but I think it was an agreement on the LVR

In the 80s? They take them out at some level and write off?

I doubt this will be happening this time around.

What have RMBS trading margins been doing?