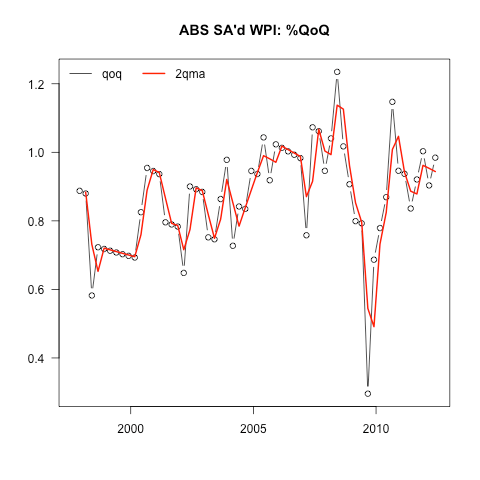

Today’s Q2 wages data (+10bps to +1%q/q v. mkt +0.8%q/q) makes it very hard to see the RBA easing rates this year.

Just Friday, the RBA told us (in the Q3 SOMP) that they expected wages to moderate further:

Private sector wage growth was little changed in the

March quarter, to be around the average of the past

decade in year-ended terms, but below the elevated

rates seen over 2005-2008. Business surveys and

liaison suggest that private sector wage pressures

may have eased a little further in more recent months,

consistent with the generally subdued demand for

labour across many non-resource industries. Over

the year to the March quarter, public sector wages

grew at the slowest pace in around a decade.

Clearly, they didn’t…

There’s a tension here between ABS data and the business surveys / RBA’s liaison. This isn’t the first the two have been in conflict this year – the RBA had relied upon feedback from liaison in forming their assessment that the economy was sub-trend in H1 (an assessment they have since revised).

Now, it could be that the ABS data is (again) wrong – and it could be that the business Turkeys have realised that they are voting for Thanksgiving when talking to the RBA’s liaison team … Or it could be something else.

Of the other, alternate, explanations, one I like is about the changed structure of the labour market.

The changed labour market laws were aimed at altering the balance of power in the labour market – in theory this means that higher wage outcomes will associated with any given state of the economy.

This story does not explain why the direct information about wage settlements from liaison and business surveys was misleading, but it does explain the acceleration in wages pressures despite an economy that is characterized by weak (or at least patchy) corporate earnings growth.

Of course, it’s also coherent to argue that with real growth above trend in H1’12, firm wage pressures are exactly what one might have expected!

If my structural story has an element of truth, we are going to have problems going forward – for the decline in nominal GDP growth (due to the falling terms of trade) means that corporate profitability must decline.

If operations are less profitable, but wage claims remain elevated, firms will adjust the quantity of labour they demand to try and maintain profits. This means a higher unemployment rate.

The nominal income boost from the terms of trade felt really good — it gave us lower than expected unemployment, better than expected profit growth, and outstanding growth of real consumption wages.

The stickier wages are, the harder the unwind will be. Expect a larger decline in corporate profits – and therefore a larger increase in the unemployment rate. The shame of today’s data is that it suggests the RBA must wait and see if that means slower wages and hence underlying inflation.

I still think that the unemployment rate will rise further and that inflation will remain low — however my confidence in my low inflation outlook has declined.

Does the ToT affect nominal GDP or real domestic income? Not saying fall in the ToT won’t hurt exporters’ profits.

Both. Assume unchanged volumes: If your export values rise by more than your import values, nominal GDP has risen, though real GDP is unchanged. However, we can buy more stuff, so real GDI has increased.

Thanks, I’ve never understood this and perhaps still don’t fully. Presumably the same effect can be produced by looser monetary policy? The risk of inflation is the same, right – for a given labour market, whether nominal income increases due to a higher ToT or lower interest rates should have a similar effect on prices and wages? If so, maybe it means the RBA was too loose in 2005-7 and too tight now, relatively speaking.

if you take out Mining and wholesale trade wages decelerated.

I don’t think they are a problem.

Thus the business surveys and the data are reconciled and your version of the change in IR laws is rebutted.

If we take out the things that are going up…

Sector outcomes are generally more contained the more decentralized the labour market – we have moved to a more centralized system, so I would expect greater spillovers. We shall see…

In any case, i do not see why it is so controversial that the new laws moved the balance of negotiation power back towards labour. The wage is a negotiated outcome, which depends on the relative negotiation powers of capital and labour. The feeling was that it had swing too much toward capital — so we elected a government to swing it back toward labour.

That has some pretty standard textbook consequences, which ought to be uncontroversial.

Have we moved to a more centralised system?

If the labour force is not growing a lot because of aging then we we have is pretty much what is happening.

Wages are not doing a lot

If you look at the ABS National Accounts measure of non-farm real unit labour costs (trend) from 1986 to 2012, you will not find a single observation where the annual growth rate exceeded 1.96%. Except for March 2012 when it was 1.97%.

IOW, the current (trend) growth rate is the highest on record (or at least as far back as 1986).

If you prefer the seasonally adjusted series, and it goes further back in time to 1972, you will find the growth rate for March 2012 was 1.89%. While not exceptional, nonetheless you will discover that this figure has been exceeded on only 17 occasions. And most of those were in the 1970s when we had a less flexible IR system.

Just saying.

Similar story,

If there is a problem with IR you would see it in the Industrial disputes ,wages and productivity data.

It ain’t there.

Standard analysis right out of the neo-con economics text book.

“Wages are up, profits down” is as inflationary as “wages down, profits up”.

But that is not we teach kids today is it? No, the owners of capital have trained all of our “economists” & RBA techocrates to equate wage pressure with inflation, and profit growth with a healthy economy – like the good paid-off lemmings they are!