Last night’s four week US T-bill auction result was a little odd.

The auction of US$30bn of four week paper was well enough covered (~83bn of bids v. ~30bn of paper), however the results reveal a fairly large change of sentiment.

Typically, these bills are better than cash, and so trade at a lower yield than the overnight fed funds rate — however there was no-one willing to bid below fed funds at this auction (the low bid was 15bps, the median 25bps and the high bid 35bps).

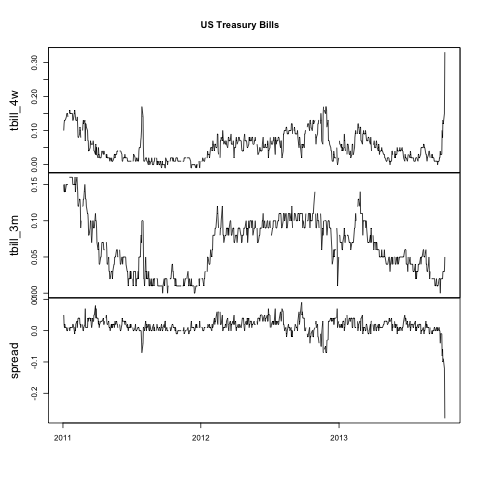

A lower 3m rate relative to the 1m rate suggests that the `market` thinks this will be temporary, however the fact that this yield spike has been larger than the similar spike in 2011 (when we last had a debt ceiling debacle) suggests to me that there’s a little less confidence in a solution this time (note the data is from FRED, with today’s closes from Bloomberg as FRED is one day behind).

A lower 3m rate relative to the 1m rate suggests that the `market` thinks this will be temporary, however the fact that this yield spike has been larger than the similar spike in 2011 (when we last had a debt ceiling debacle) suggests to me that there’s a little less confidence in a solution this time (note the data is from FRED, with today’s closes from Bloomberg as FRED is one day behind).