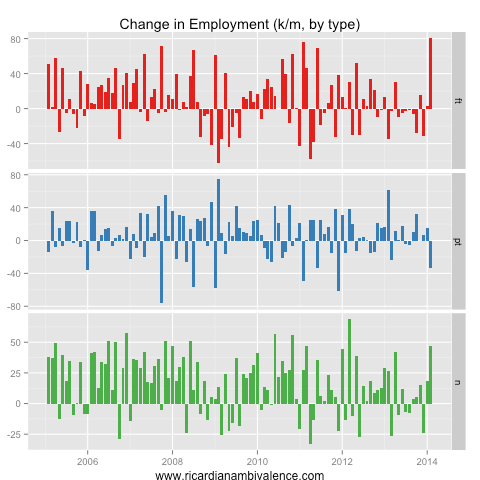

Getting right to the point, my view is that the Feb 2014 jobs report is bunkum. The survey is not designed to measure the number of jobs, and if you use a household survey for this purpose you are going to get stupid results some of the time … this is one of those times. After accounting for the silliness, the number of jobs added in Feb 2014 seems more likely to be -5k, rather than +47.3k.

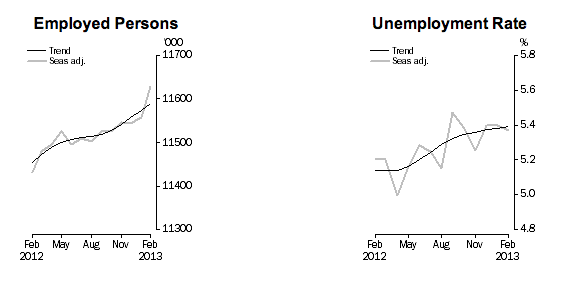

We’ve seen this before — just last year in the Feb 2013 Jobs report. Check it out, and you’ll remember the prior ‘turning point’ in the labour market – the +71.5k jobs was evidence that all the prior reports were bunkum, that the labour market was responding to lower rates, and that rate cuts were over ….

Except that it wasn’t … it was a bug due to sample rotation and bad seasonal factors, and not only did the RBA cut in May and August, but the number has since been revised down to a more sociable +26.6k.

Yesterday’s report had the same problems – and the ABS (again) made a statement reporting that there was an issue with sample rotation.

Anyhow, it’s worth reviewing the data in any case, because the new seasonal factors change the story a little. First, note the slightly better performance of the labour market over the last few months. This now seems more consistent with GDP and business surveys.

Regular readers will know i dislike the jobs numbers in part as i do not trust the population benchmarks – the right way to get around that is to look at how the proportion of the population in work is changing. Even after seasonal reanalysis the employment share remains weak (excepting Feb).

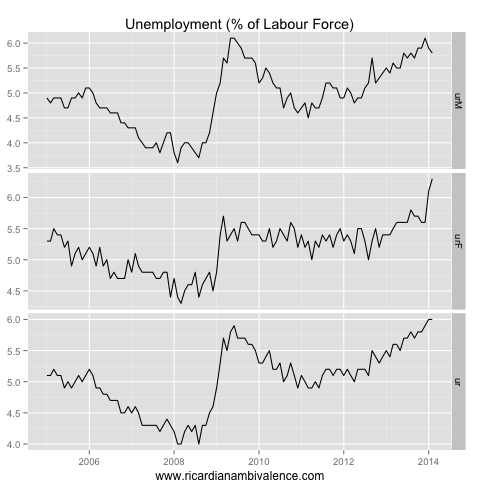

Reflecting this, the unemployment rates continue to trend up. Another odd feature of the new data is the spike in female unemployment. It looks like this is tied up with the sample issues (they produced a spike in employment, full time employment, and participation). The unemployment rate rose 5bps to be just a whisker under 6.05% — so we almost printed a 6.1% on the screens.

The higher participation rate (more people looking for work) hid in part the higher employment estimate. The employment to population ratio exposes this clearly – it’s a small uptick (and it might not be real), but there’s still ample slack in the labour market.

My bottom line on this report is that it’s a bit of a joke. The trends are consistent with an economy that’s responding to lower rates as you would expect – but it’s still not clear if that’s going to be enough given the headwinds that are blowing from resource investment, fiscal policy and (potentially) slower Chinese growth.

The Labour force underutilisation rate (trend) is unchanged from Nov at 13.5%: this is the highest since Aug-2009 and before that Nov-2001.

Also, quite strangely, total hours worked have fallen in FEB apparently, reversing all of last month gain. Yes, this survey is much too volatile and economists should focus on the % trend, not the absolute numbers or SA numbers.

Thanks guys. Westpac seems to have a similar view, saying UnN will keep rising to 6.5%.

Back to an old theme, a lot of commentators have been saying they expect house price growth to slow this year. I’m thinking the opposite, especially if we don’t see multiple/consecutive rate rises until next year. This seems to be what’s going on in the UK.

I think you might be right, often the “unexpected” is to be expected. In that case, it’s going to be interesting to see what the RBA will do. They will not want to raise rates, maybe they’ll push for solutions similar to NZ.

We’ve already heard the ‘buffer’ concept floated by Stevens, with banks being required to check if borrowers can withstand an X% increase in rates. I think it was raised by Luci Ellis in the context of saying standard ‘macroprudential’ policies – eg LV caps – are undesirable. I can’t see legislated buffers working and I don’t think they make any sense. Banks already do this to some extent, in their own interests. But forcing them to do more? Couldn’t banks and borrowers legitimately claim that large buffers were unnecessary if they took out fixed rate loans? And couldn’t most borrowers legitimately say that if rates were increased 4%, it must mean their wages would have grown significantly by then, enabling them to cover higher repayments? I think far better for the RBA to recalibrate their standard rate moves over time (as they have in the past) if they are concerned about sending people to the wall. After all, if they only need to raise by 15bp to get the same bang for buck as 25bp does now or 50 bp did 10 years ago, then so be it. Anyway, the much bigger risk is that the RBA will over-tighten, cause UnN and *that* makes borrowers unable to repay. And virtually everyone would have problems repaying if they lost their job.

I like limiting LVR because one avoids negative equity if house prices fall and you buy part of a house with savings.. The buffer thing won’t work if you lose your job. In the US house prices fell heavily and the UE rate shot up, you can withstand that only if you are not overextended and have been saving some. And what buffer for interest only loans?

Regarding banks and their own interest that’s short term profit they uninterested in planning for the unlikely scenario.

Well, Bill Evans has dropped his rate cut call on the jobs numbers, with first rise in 2H15. Koukie is calling for a rise in May!

RBA minutes:

“Members noted that rising housing prices and household borrowing were expected results from the monetary easing that had taken place. While these factors were helping to support residential building activity, they also had the potential to encourage speculative activity in the housing market. Lending to housing investors had been increasing for some time in New South Wales, and over the past six months it had also picked up in some other states. While such a pick-up would be unhelpful if it was a result of lenders materially relaxing their lending standards, current evidence indicated that there was little sign of this occurring. Members noted that the recent momentum in households’ risk appetite and borrowing behaviour warranted close observation, but agreed that present conditions in the household sector did not pose a near-term risk to the financial system. Members discussed the experience in other countries where macroprudential tools had been utilised to slow demand for established housing and their possible application in Australia.”

…. current evidence indicated that there was little sign of this occurring ….

?

… and where exactly are they getting this evidence from???? The US Fed had no idea or info on any bank collapsing in the US until it actually happened in 2008, but the RBA want us to believe they know exactly what’s going on inside commercial bank offices… not even the bank CEO knows!!!!

http://www.bloomberg.com/news/2014-03-19/swedish-bankers-tighten-amortization-rules-to-stem-debt-growth.html

Stevens today:

“It is unlikely, though, that a pick-up in resources exports, as important as that will be, will be enough to keep overall growth on the right track. It will be helpful if some of the other areas of domestic demand that have been subdued start to grow faster. For that to occur, households would need to have made progress on their desire to sustain higher saving, and to consolidate debt where needed. Businesses outside of mining would need to have made some progress in containing costs, and raising efficiency. They would also need a bit more confidence about the future than they did before, as a pre-condition to making plans to lift their investment and add to their workforces.”

As if households’ desire to consolidate debts and businesses’ desire to contain costs are purely exogenous.

What is going on?

Ricardo is this blog still alive??

Not presently, but nor is it dead. It is just sleeping…

When will you be waking from your sleep then?! Hopefully soon…