The RBA’s August RBA meeting is only days away. While there’s still some uncertainty about what they will do over the next few months, we do know a few things.

1/ It’s downgrade time: GDP down, Unemployment rate up, wages and inflation down.

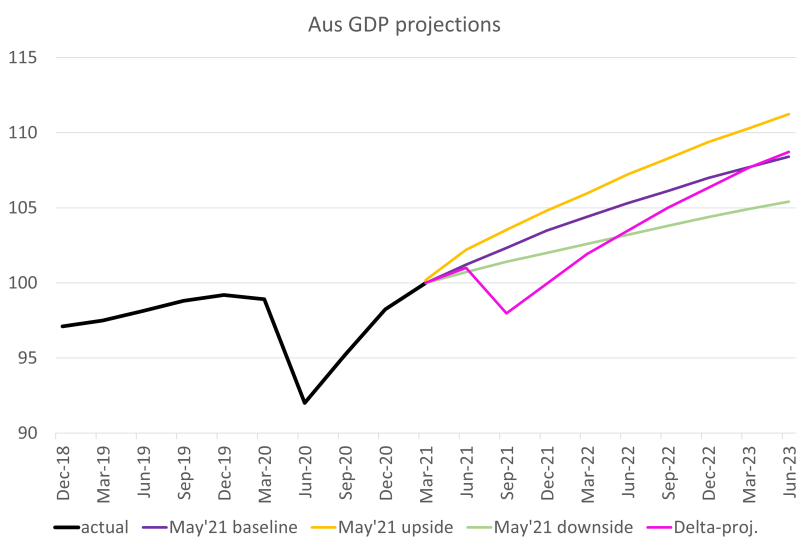

Forecasting is a hard gig, and forecasting during this pandemic has been even harder. Still, we can say with some certainty that the near term consequences of the most recent COVID /Delta outbreaks and lockdowns will deliver a path for GDP that’s substantially below the downside scenario in the May SOMP.

Less GDP means a wider output gap and a higher rate of unemployment. The wider output gap should dominate the higher-than-expected outcome for Q2’21 Trimmed Mean CPI (the RBA was expecting a bit below 1.5%yoy v. actual 1.63%yoy, the red star on the chart below). This should slow forecast inflation across the outlook and delay the return of target inflation.

2/ Back to COVID-based scenarios

For the four SOMPs, from May 2020 and to February 2021, the RBA’s economic scenarios were based on the outlook for COVID. That changed in the May SOMP. It’ll change back in August.

In the May SOMP, baseline scenario had the only COVID content:

“The baseline scenario is based on the assumption that the domestic vaccine rollout accelerates in the second half of the year, allowing the international border to be reopened gradually from early 2022. This scenario assumes that no further large outbreaks and accompanying extended hard lockdowns occur within Australia, and that restrictions, when imposed, are brief.”

The reason for the change in May is that the RBA was gearing up for the transition from ‘recovery’ to ‘expansion’. Australia seemed to be basically done with COVID, apart from the closed boarders. So the RBA’s scenarios were couched in terms of the willingness of households to run down their savings and of firms to invest. The upside scenario had households increasing spending by more than the RBA expected; this seems to have been broadly the path the economy was on prior to the current outbreak. The downside case had cautious households being more cautious about consumption.

Given the more problematic nature of the Delta strain, you’d have to put a greater weight on the probability that households might be more cautious about their spending plans over the outlook. This would have been likely, even without the complications of the Delta strain. Prior to the recent outbreak, many Australians figured that we were done with COVID (for example, many of my mates hadn’t signed up for the shot long after they became eligible).

It follows that there’s reason to think that the rebound from the current lockdowns might be slower.

And there’s always the risk that the current lockdowns are extended past the end of August, or made more severe if case numbers remain stubbornly high.

Finally, the expectation that boarder re-open in early 2022 seems likely to be pushed back.

3/ A Taper reversal is very likely: the RBA will continue QE at 5bn per week.

We can be reasonably certain that the RBA will reverse July’s decision to slow the pace of bond buying by 1bn per week, to 4bn per week.

When they made that decision, they said that they would move the number up or down according to economic conditions. We now have a certain contraction in Q3, and a possible contraction in Q4.

The risk of a double dip recession is enough to meet any reasonable application of their economic test. So the pace of QE will almost certainly be pushed back up to 5bn per week. I don’t expect an acceleration to 6bn per week.

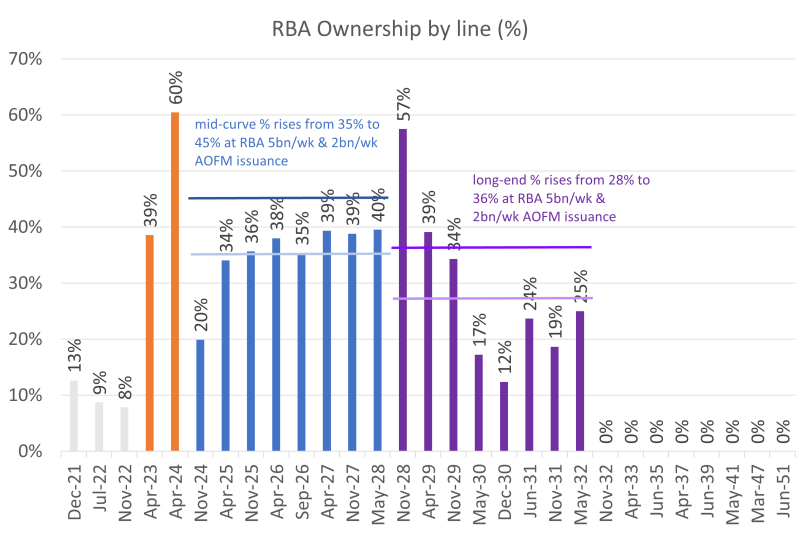

I am very open to the idea that the RBA should do more to boost the economy, but it seems too soon for this decision. If they wanted to boost QE past 5bn per week, they need to re-design their QE policy to extend its life. At the moment, they buy too many mid-curve bonds relative to AOFM issuance, and their footprint in this part of the market is marked. Unless the AOFM changes their issuance strategy, this will constrain the current QE policy (see my note What can the RBA do for more on this topic).

They could fix this problem by buying ACGBs across the curve in each open market operation (rather than buying mid-curve on Monday and long-end on Thursday). A longer term solution would be to buy across the entire ACGB curve; this would add ~100bn of stock to the eligible universe. They might also boost share of Semis above the current 20% (the RBA holds less than 20% of the eligible universe of Semis, and even less if they added ultra-long Semis).

4/ RBA sources are mostly on board with a taper-reversal

A taper reversal was confirmed by the AFR’s Kehoe after CPI, in his article “Inflation Genie is not out of the bottle”. In that note, John said that “the bank is almost certain to delay the planned unwinding of its $200bn government bond buying program”. This was not his first time delivering this message. He wrote much the same story on 19 July.

The WSJ’s James Glynn, also a very reliable RBA-watcher, wrote on 17 July that “The lockdown that is crippling Sydney looks set to extend indefinitely, sharply increasing the risk that the Reserve Bank of Australia will have to suspend plans to taper its bond-buying in September”.

Awkwardly, the Herald Sun’s Terry McCrann has taken the other side.

He wrote, post CPI, that “there will be no change to the RBA’s interest rate and other policy setting at its meeting next week; and, even more importantly, to it’s rhetoric about future inflation and interest rates … calls for the RBA to reverse its decision to trim its QE program from $5bn to $4bn a week are as completely clueless as the calls for the Federal Government to reinstate JobKeeper.

Terry used to be the man for RBA tips. We shall find out next week if that’s still the case. I think that the RBA will dump the taper, and continue buying at 5bn per week. I think that’s about a 75% chance.

5/ The RBA might put YCC back on the table

This is entirely my personal view. My belief is that the RBA was earnest in saying that they hadn’t made up their mind about a YCC extension at the time of the May board meeting / SOMP and that the decision was mostly an economic one.

In July, when they decided to freeze YCC at the April 2024, they were looking at an upgrade to a new central economic scenario that was around (or a bit above) their May SOMP upside case. Following the COVID /Delta outbreaks, and consequent downgrades, they are now looking at a downgrade to a new central economic scenario that’s worse than their May’21 SOMP downside case.

I believe that if they’d have extended YCC to November 2024 if this had been their base-case at their 6 July meeting. It’s going to be the base case at their 3 August meeting, so saying that un-freezing YCC is an option should at least be on the table (saying it, not actually rolling to Nov’24). I put this at 50%