The biggest problem in Aussie macro is weak household cash flow. Today’s Aussie Business Indicators report suggest that things are getting worse — not better.

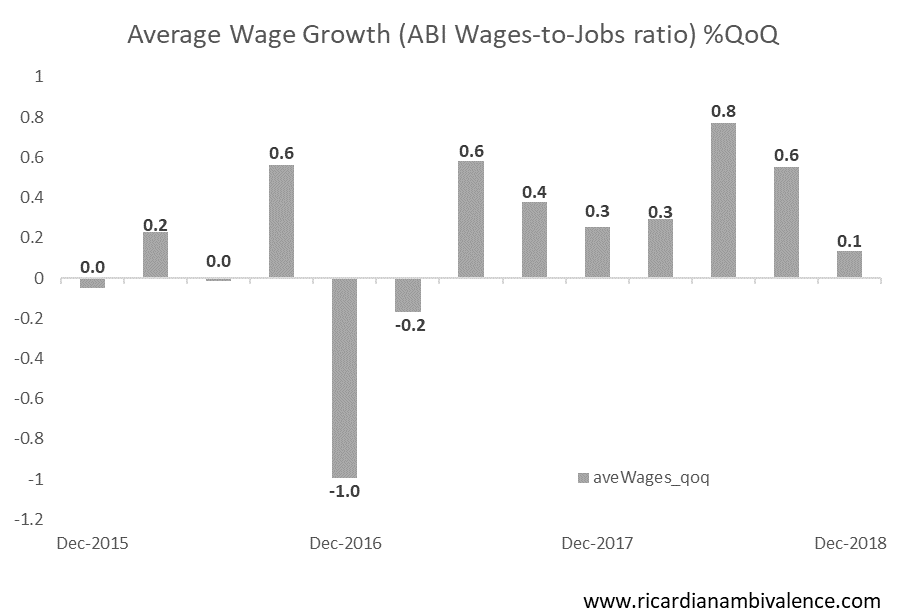

On the quarter, nominal wages and salaries paid by the private sector grew by a little less than 80bps. This was the slowest pace of growth since March 2017.

Most of this was due to employment growth of a little over 0.6%q/q. If you subtract out employment growth, average wages grew by a paltry 0.1%q/q.

So how do we solve this problem?

Re-regulation of the labour market? I think that even this would not do a lot because of union decline

Let the economy run hotter. Get unemployment rate down to 2%

Does that wages and salaries measure include bonuses, which the ABS data suggests have been higher of late? If so, how could they be reconciled?

The wage price index is a stratified quality adjusted measure of hourly rates of pay. This is cash money paid.

Hmm,

It is at full employment in the USA yet wages are still not anywhere near where they should be.

The other question is how to get the economy hotter. I can’t see how lower interest rates than the present 1.5% wi;l do anything much.

I favour stronger infrastructure spending.

Who knows where full employment is. Just keep up the pressure and eventually you will get inflation.

well they have full employment in the US of A but no wage pressures and therefore no inflation problems.