The monthly labour market report has a way of making fools of people — but in the last two months i think it’s mostly made a fool of itself.

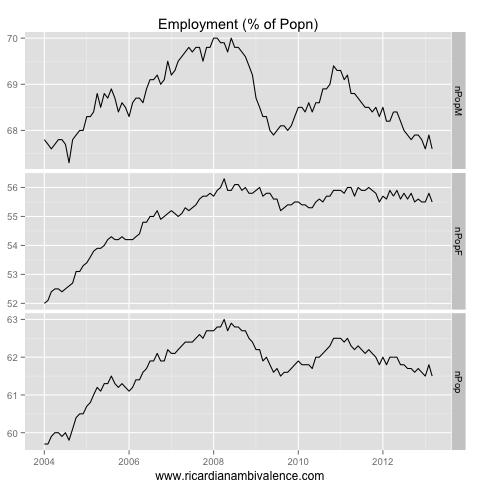

At the margin, it has made me think that the RBA is more likely to resume cutting in 2013 (i had been thinking that would not come until 2014 when mining investment tailed off) — but it’s only a marginal change. Employment to population rates remain low, and my hunch is that this means we will see further softness in wages and therefore non-tradable inflation.

The balance of supply and demand in the labour market is in about the same shape just now as it was in 2009 — only this time the housing market isn’t on fire (due to government handouts) and we don’t have a mining investment boom coming.

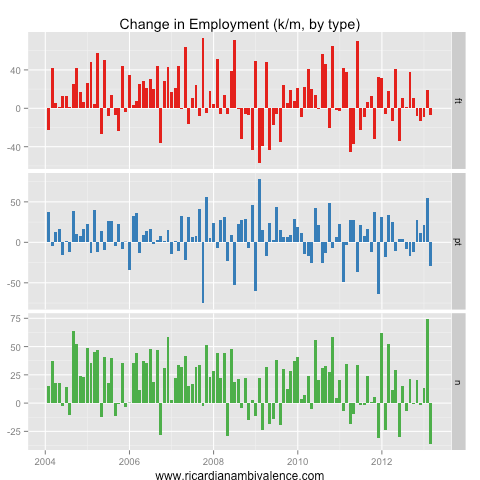

It seems unlikely to me that employment either rose by 74k in Feb or fell by 36.2k in March. As always the trend (12.6k/month) is more likely closer to what’s happening — after abstracting from seasonal factors etc.

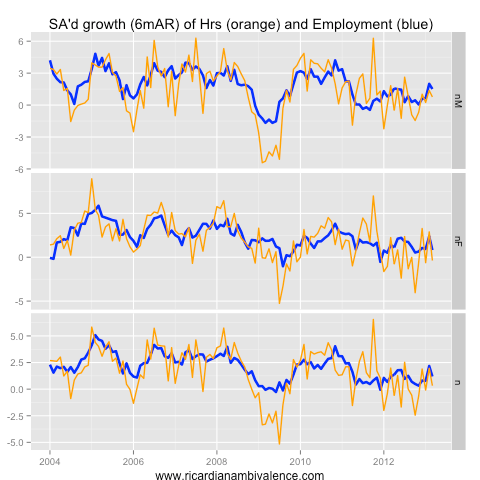

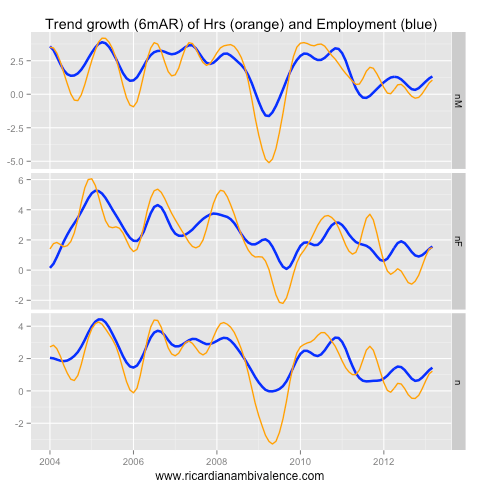

Looking at both hours worked (which declined by 0.3%m/m) and employment, the bottom line remains that labour demand is weak. It’s neither so terrible that the RBA must cut rates right away, nor good enough to stop the unemployment rate from rising.

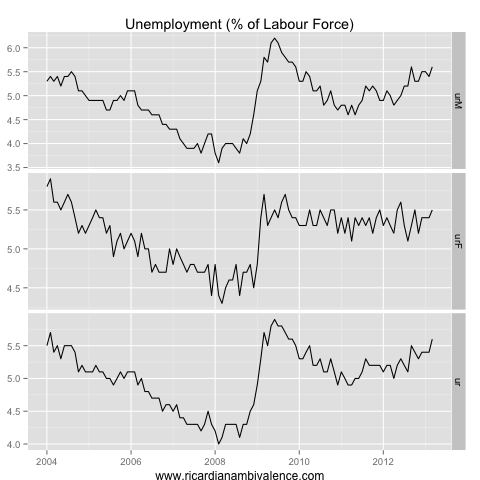

In trend terms, it looks like things have turned up a little — however once one takes into account the growth of the population (and hence of the labour force) it’s fairly clear that there remains plenty of slack in the labour market.

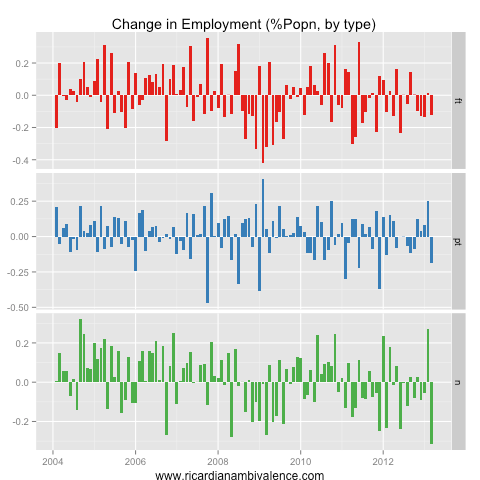

I think that the above chart — showing the change in the proportion of the population that’s employed in each class best tells the story. Full time jobs are being lost and part time jobs are basically holding in there.

As men tend to have full time jobs and women part time jobs (on average) this is showing up as a trend increase in the male unemployment rate. I suspect that this also reflects the fact that men are more likely to be engaged in Manufacturing and Mining — sectors which are presently under pressure.

With the AUD at multi-decade highs in trade weighted terms, it seems likely that the pressure on these sectors will remain (it may even increase). Given this, it seems more likely to me that the unemployment rate will keep heading higher — and if that happens, they will most likely resume cutting the cash rate at some point.

How has it made a fool of itself? The way I look at is that Seas. adj is just a residual of determining Trend estimates. Therefore, if you want to use a by product of a procedure well your the fool not the process

Agreed, the trend is the thing — as I emphasised in the post. In my view if you’re emphasising the jobs estimates, in any case, you’re on thin ice.

If the high AUD is the problem (is it still debatable?) and 175 bps have lowered the AUD by less than 5% since 2011, then I can see at least another 1% of cuts in the medium term. Only the USD could perform better by end of 2013 (MAYBE), YEN and EURO will be stay depressed. In this post-boom environment I can’t see inflation or house prices being a problem.

Forecasting FX is a devil of a thing, but it seems to me that we are set up for a higher AUD just now. The trade balance is improving, the market is short, and the RBA is flirting with dropping their easing bias.

I think AUD is at the top, and long AUD has bigger risks than any potential reward. Well actually all shares markets and the risk trade looks “toppy”. RBA has made it clear they would not want further AUD appreciation. Do not fight central banks. After this week data RBA is not going to drop easing bias. Did you see business conditions? Rates are on their way down.

BTW you are always a AUD bull and I am always a bear :)

News of the week:

“U.S. to Press Japan to Refrain From Competitive Devaluation” !!!!!

http://www.bloomberg.com/news/2013-04-12/u-s-to-press-japan-to-refrain-from-competitive-devaluation.html

I am. That’s true. I think the fiscal strength matters for fx valuation, so I like the AUD. It has basically ranged for 2yrs, so holding long has paid via carry.

Australian cash rate and differential too low now for carry trade.

well, it’s worked the last few years. AUD is rangebound and vol is low, so it’s paid. best way would have been to sell puts when vol was higher. i’d still sell downside.

Carry no longer pays enough for the risk. It was better when:

– AUD on a clear uptrend, not rangebound.

– Rates / inflation on the way up.

– Rate differential with other currency much higher.

Kouk looks like he is dropping his 3% cash rate call and now favouring May cut. Flipper. Joye is pure genius in his AFR column. Nothing quite like him:

http://www.afr.com/f/free/markets/market_wrap/the_great_super_scam_H4pC03bRceW2trOXMOWbNK

Joye , you should stop spamming this blog.

As I said, somehow the computer knows how to allocate the right avatars. The one above you suggests s/he’s on ice.

Ricardo, what do you think: at which level unemployment will require further cuts in RBA mind? Suppose we get OK inflation (0.5% core or less), will they cut in May if unemployment is confirmed at 5.6% and TWI stay at record high? Or they need to see the unemployment uptrend continuing? Would they prefer to cut now and raise shortly after if needed, or not cut now to avoid the risk of having to raise later. What do you think? thanks

One other thing, if you do not mind. Suppose we get inflation in the upper band, let’s say 0.7% or more. But unemployment keeps its uptrend. And house prices keep going. Would they cut then? Would they favor employment over inflation?

I think the RBA expected the unemployment rate to keep drifting up for a time, so the current uptrend probably won’t worry them too much — but they have an easing bias because they are close to easing, so it’s not that far away. If the unemployment rate keeps trending up and inflation remains low, they’ll cut at some point: my guess is that point would an unemployment rate that’s above 5.75%

More than just the unemployment rate, however, i think it’s about the leading edge positives fading. If we get some combination of consumer confidence back below 100, equity prices falling ~10%, house prices flattening out, then the RBA would have less confidence that they have done enough to ensure a smooth hand-off from mining investment to other sources of demand.

Right now, i think that they’d see the labour market data as possibly lagging the more positive signs on the asset prices / consumer side.

Pretty ridiculous if you ask me. Post the GFC, UnN topped out at 5.8%. Now, with a mining boom underway, they stop cutting in December and just sit and watch UnN rise towards the same level. If CPI is lowish next week, they should cut again in May and perhaps June as well to cement the upswing. No excuse not to – there is no reason in the world we need to be facing an UnN rate approaching 6% at a time when our economy is getting some tailwinds.

I am usually the one reminding everyone that all the rba does is set the price level – now i am welching on a rate cut despite rising unemployment and low inflation … Need to spend some time in the house of mirrors :)

no cut then

spot on Ricardo

nice charts …

Thanks. Means a lot coming from you :)