The May labour market report was a little better than I had expected (and the market also): the unemployment rate rounded down to 5.5% (it fell 3bps to 5.53%). Total employment was stable (+1.1k), so it follows that the unemployment rate fell due to a decline in the participation rate (-10bps to 65.2%).

In trend terms, the labour market remains as RBA Gov Stevens described it (when his board cut rates) in the May post-meeting statement:

Employment has continued to grow but more slowly than the labour force, so that the rate of unemployment has increased a little, though it remains relatively low…

Given that everything is measured with error, it’s these trends that matter: with a growing population, zero jobs growth will not restrain the unemployment rate … and it’s not. In trend terms, the picture remains unchanged — the unemployment rate continues to moving up slowly.

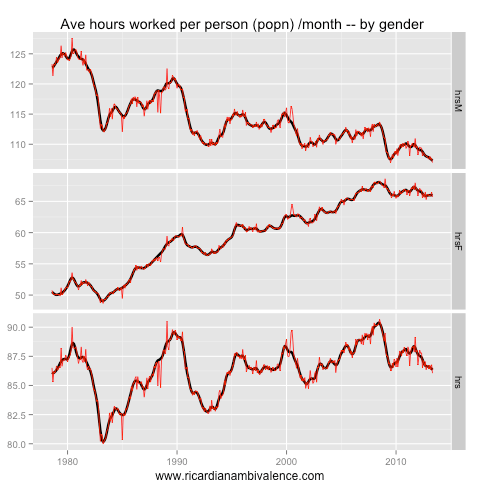

As might be expected given that the ‘weak’ anecdotes are coming from male dominated sectors (mining and manufacturing), it’s unsurprising that the uptrend in the unemployment rate is clearer is the male labour market — however it’s notable that the female rate now appears to trending up also (though it remains in the range it has been in for the last four years).

Looking at the employment report, the 1.1k increase in employment was comprised of a 5.4k decrease in full time employment (male -7.8k, female +2.4k) and a 6.4k increase in part time employment (male +15.7k and female -9.3k).

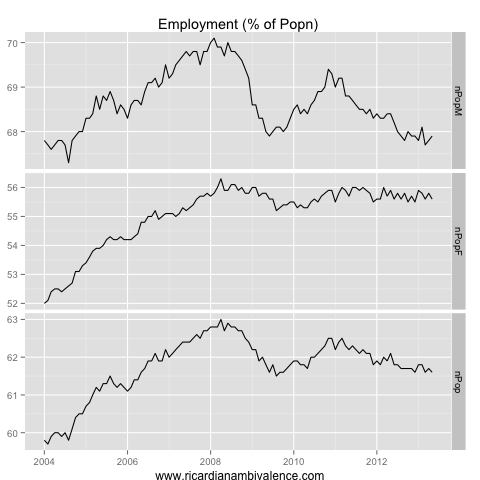

I am not much of a fan of the job number estimates, as they are sensitive to changes in the population benchmarks, so i find it more informative to look at the change in the proportion of the population that’s employed by type.

On this basis, the employment to population ratio fell 8bps to 61.63% (due to the participation rate falling 10bps to 65.2%). The proportion of the population with a full time job fell 9bps (to 43.09%) and the proportion of the population with a part time job rose 1bps to 18.55% (yes: I am aware that the second decimal place is mostly noise).

As a result of this long term change, the proportion of the population is now only 10bps above the GFC low of 61.5%. The proportion of the male population with a job (67.9%) is presently at the GFC low, up from a fresh cycle low of 67.7% in March. At 55.6% the female employment to population ratio remains ~40bps off the 2009 cycle low.

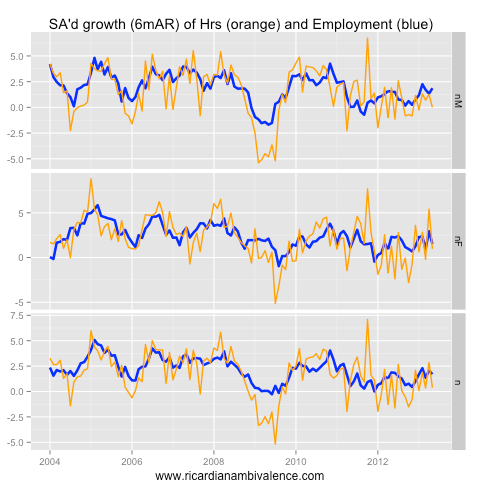

The weakness we hear about appears to be showing up (again) in hours worked. Aggregate hours worked fell by 0.7%m/m in May, due to a 0.8%m/m drop in full time hours and a 0.1%m/m increase in part time hours. Male hours worked were down 0.5%m/m and female hours -1%m/m — reversing recent positive signs in this part of the labour market.

Removing the impact of population growth (by looking at average hours worked per head) men are working fewer hours on average now than at the prior cycle low, and women are working around the same.

All told, there appears to be ample spare capacity in the labour market, and in that context i would expect that inflation will remain low.

It is weak enough for the RBA to cut in July — without seeing the Q2 inflation data — i think so. The trend toward lower labour demand seems clear in this data, and also in the job advertising data: the RBA hasn’t waited for the unemployment rate to spike to cut rates this cycle. I don’t see why they’d start now.

Ample spare capacity indeed. The hours worked in particular look miserable. This should be the point in the cycle (investment is topping out) where inflation should be peaking above the top of the band and unemployment hitting cycle lows. Instead, we have the opposite and still a decline or collapse in mining investment to come. The path of least regret has been easier policy for over 2 years now. Sure, we might get 25 bp next month, but the RBA has shown no real determination to build some sort of buffer against recession. I really wonder what they’re so worried about.