It’s been ages since I blogged here — partly because the issues facing the Australian Economy haven’t changed much over the past year or so. Inflation is stuck at a pace that is too low (at least relative to the RBA’s high-ish 2.5% target), and there isn’t much that the RBA is willing to do about it. There is something new now — the housing market appears to be in the midst of a slow melt down, and the molasses is slowing the broader economy.

Don’t expect the RBA to do anything about this. RBA Gov Lowe and Assistant Gov Kent are, after all, a founding members of the financial stability club — they wrote Property-price cycles and Monetary Policy together in 1998!

Those who think that the RBA is going to care much about a housing downturn ought to read this paper very carefully. The point of the paper is that once you have a bubble a period of slow growth and low inflation is inevitable — and that the monetary authority would do better to bring it on sooner to limit the damage.

“Monetary policy can burst property-price bubbles. Under some circumstances, it may make sense to do so, even if it means that expected inflation is below the central bank’s target” (my emphasis).

So a period of slow growth and low inflation is the expected cost of cleaning up the mess. Put another way, the current period of low inflation is expected — and any future slowdown that’s due to a housing correction is to be ‘toughed out’.

What’s the point of all this suffering? They argue that it’s to avoid an even larger mess later.

“When the bubble bursts, losses are likely in the financial system and economic growth is likely to be below trend. But once a bubble has emerged, avoiding such an outcome will prove even more difficult. By bringing forward the collapse of the bubble, monetary policy can reduce the scale of the inevitable slowdown in economic activity. The main difficulties with such a policy are in identifying that a bubble does indeed exist and generating the necessary public acceptance of a period of tight monetary policy.”

Everyone knows that the Australian housing market has BIG problems. The RBA knows that it’s (partly) to blame — though the Royal Commission’s interim report blames lax regulators most of all. Monetary policy was too loose given regulatory settings. And the RBA just acknowledged, in their October meeting statement, that “credit conditions are tighter than they have been for some time”.

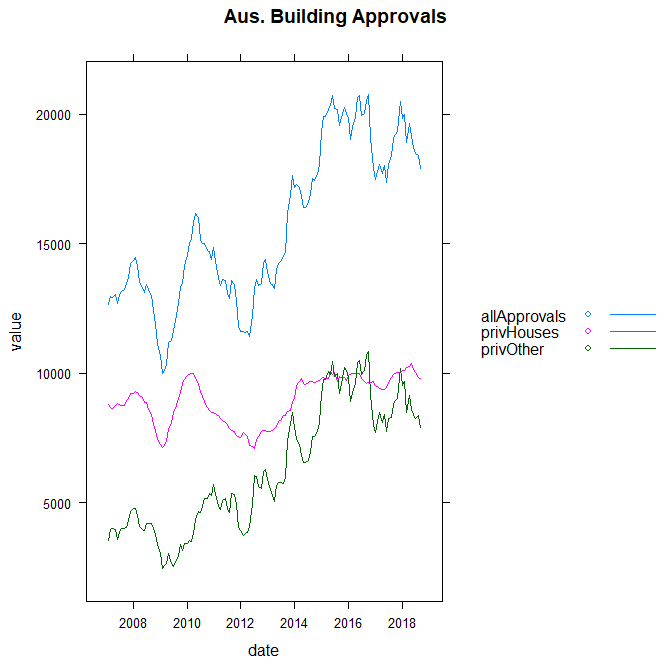

Meriton Harry Triguboff, Australia’s largest builder of apartments, says he has stopped buying land. With the builders no longer buying land, approvals are crashing — in raw terms, they down ~25% from the peak in Q4’17. This is due to ‘private other’ (mostly apartment) approvals falling ~45% over that period; private House approvals are down a modest ~4%. While part of the drama of these numbers is the unusual peak in Q4’17, even smoothed numbers are bad (I use 3mma in the below chart: they are All -13%, Apartments -25% and Houses -2%).

… and we haven’t even got to the reset of the ~600bn of dodgy interest only loans. That’s next year’s problem (with a hangover that will last until 2025).

good to have you back

Thanks

Can we please have a few regular more articles? Maybe just one a fortnight

Pretty please

I will try

Welcome back (again!).

That’s really interesting on the Lowe & Kent paper. It certainly seems to accord with the RBA’s behaviour. Funny how it preceded any real housing boom though, unless you count the 87-89 jump. If they do, I hardly think one could say that that property bust caused the early 1990s recession.

On your later points, I’m a bit surprised by the apparent strength of your view that the Oz housing market has big problems. I certainly don’t think banks should lend on the basis of fake income & expenditure data (it seems that arose mainly due to a principal-agent problem between the banks and brokers) or presumed ongoing positive real price growth assumptions, but I’m not sure either of these things happened to a massive extent. As for the IO resets to P&I, I think many have already happened. Short of a big national income boost from further rises in commodity prices, I don’t see rates going up in a hurry. So… why are you so pessimistic?

Next post i will color in the housing view a little more

See new post

I have a new publication in the journal Economic Analysis and Policy on the evolution of the RBA’s financial stability mandate and its relationship to the inflation target. Copyright restrictions prevent posting full text online, but DM if interested https://www.sciencedirect.com/science/article/pii/S0313592618302455

My article in Economic Analysis and Policy on the RBA’s financial stability mandate and low inflation is out from behind Elsevier’s paywall for the next 50 days

https://authors.elsevier.com/a/1Y5NB17JNudZlt