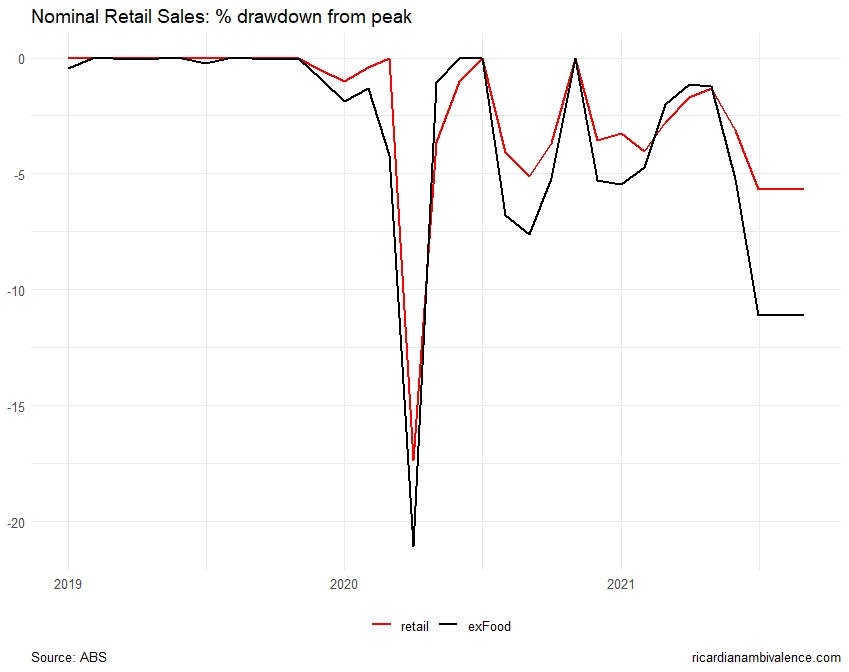

The July retail sales report was a bit weaker than expected: falling another 2.7%m/m (mkt -2.5%) to be down 5.7% form the Nov’20 peak. Retail spending ex-food fell 6.2%m/m (following -4.1% in June), to be down 11% from the Nov’20 peak. It’s worth reflecting on that fact for a moment: the peak for retail sales was November 2020.

As you’d expect, the weakness in July was mostly driven by NSW (the Delta-lockdown). Given that lockdowns broadened in August (Victoria entered a statewide lockdown on 5 Aug, plus regional NSW and the ACT in Mid August), the level of retail sales in August is likely to be lower than in July. However for the purpose of this post I’m going to assume retail sales are flat at the July level in August and September.

It might seem early to be talking about Q3, however we have most of the information we need to shape a view on Q3 retail sales (Q3 is made up of six months and we know four of them) and Q3 GDP.

Making the generous assumption that retail sales are stable at the July level in August and September, nominal retail sales will fall by 3.7%qoq in Q3. This is the worst ever nominal QoQ result.

Worst ever.

Worse than 2008, or 2020. As you can see from the first chart, the draw-down in 2020 was sharper, but the QoQ result was saved by panic-buying, work from home spending, and some fortunate timing. But in terms of Q3 GDP, the headwind from retail sales has never been stronger.

People have to eat, so the ex-food spending numbers tell the story better. Assuming that ex-food spending is stable at the July level in August and September, ex-food retail sales will fall by 8.8%qoq. Again, this is the worst ever result.

It follows that retail sales are likely to subtract 100bps from GDP all by itself. History suggests that services spending will subtract more than that. Note that this is making the generous assumption that there’s no further decline in August or September.

The RBA ought to be rattled by this — it suggests that they were missing something when they finalised the August SOMP forecasts. While subsequent events have made it obvious that their August SOMP forecast of -1%qoq for Q3 GDP was wrong … the fact is that this forecast was finalized on 5 August! So this had already happened.

The RBA’s liaison / nowcasting program should have picked up this weakness. The fact that it didn’t ought to make them a bit more cautious about the rosy rebound that’s embedded in the August SOMP. My hunch is that they had these forecasts mostly worked up for the July QE decision, and just took a bit out for the COVID outbreaks.

Finally, the weakness in retail sales speaks to some of the differences this lockdown. Government support is less wasteful generous. People already have home office stuff. And a garage full of junk that was impulse-purchased during the 2020 lockdowns. So just in terms of the fiscal / retail dynamic, we should expect less lockdown-buying; and a less vigorous recovery than we saw in H2’20.

We should also expect more cautious households and firms — as this will be an endemic-COVID recovery (despite the vaccines). H2’20 was a post-COIVD recovery.

One comment

Comments are closed.