With the drop in the AUD, assessing financial conditions is (again) becoming a hot topic. It’s a tough thing to do, because we must answer questions like: is the AUD (appropriately) weaker because the economy is weaker or is it weaker than that, so that it’s boosting things?

To get around these thorny issues, I like to look at actual financing activity — and the housing finance report is a key part of this particular puzzle. Overall, the report shows a modest response of volumes to the rate cuts to date, but poor performance of values — which reflects the basically flat house price profile this easing cycle.

Relative to prior easing cycles, activity remains subdued, and values growth weak — which means there remains ample scope for further rate cuts (i expect the next one in July).

Aggregate values (Owner Occupier plus investor housing finance) show the difference between cycles very clearly — nearly two and a half years since the cash rate peaked, and after 200bps of cuts, the total value of approvals are only 11% above the total value when the cash rate peaked in 2010. In prior cycles the RBA had generally started tightening by now, so the comparisons should start improving.

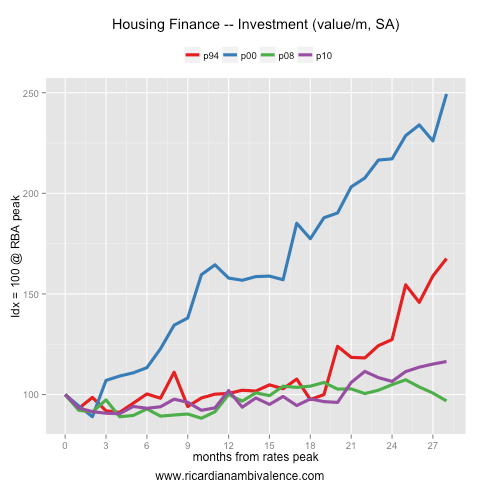

Investment has been the bright spot — values are up ~16% from the start of the easing cycle. This is nice, but is very modest next to the two easing cycles prior to the GFC cycle (the 1994 and 2000 rates peaks).

This is mostly a price-thing — owner occupier housing finance volumes (excluding refinancing) are up a decent 10% from the 2010 cash rate peak. Again, the weakness in volumes by this point is due to the fact that the RBA had typically begun tightening by now.

The brightest spot is financing transactions for the purchase of new homes. These are up ~50% from the first rate cut, which is better than all prior cycles.

Importantly (for employment) the pickup in home purchase applications is starting to lift construction finance applications. The volume per month is now ~10% higher than at the 2010 cash rate peak.

The weakness in values (and implied price growth), and only modest response of volumes (outside of purchase of new dwellings) suggests to me that interest rates have only recently become stimulatory. Even with the lower AUD, there’s every reason to think that lower interest rates are the path of least regret — there’s basically no sign of housing being ‘over-stimulated’.

On investment: “very modest next to the prior two easing cycles”. Don’t you mean the two cycles prior to the 2008 cycle?

Agree with your conclusion. Rates only became stimulatory late last year and the recent equity market correction has tightened financial conditions again. To offset even a slow mining bust, we need much more housing investment and I find it hard to see how this will happen without a significant appreciation in prices,

Rajat, but can we see significant appreciation in house prices if consumers have decided it’s time to save now and do not want to get into more debt? I mean we can make money cheaper to borrow, yes, but how cheap is cheap for something you do not want. If the plan is lowering rates so we can make already expensive houses go even higher, it’s not a good plan IMO.

Today I heard a comment for someone on the business channel that made lots of sense to me. He was saying:

a) We can’t force our economy to grow at 3% if consumers do NOT want to grow at 3%. No matter how easy monetary policy is.

b) A lower AUD could make things even more complicated. A high AUD has allowed consumers to save, but a lower AUD will make us poorer, saving even harder, and that will lead to even more savings. He was saying that a AUD in the 0.80 would be a guarantee of a recession and he was against further rate cuts.

I personally think more rate cuts will come, and I hope that will stimulate other parts of the economy like consumption, construction, but without households getting into more debt which is already at very high levels.

Demand for credit is strongly derived from one’s view on future NGDP growth. I don’t accept that people’s desire to borrow is ever invariant to monetary conditions.

I completely disagree with your business channel guy on both (a) (assuming productivity and population keep rising, why not 3% pa?) and (b) (because it is “reasoning from a price change” – we need to know why the dollar is falling to know whether 80c would be associated with a recession).

mmmmmm, you think consumers even know what NGDP is? you think when you sign-up for a 500K mortgage you are thinking of future NGDP growth?

I do not completely agree with the commenter, but:

a) Saving rate has jumped and does not look it’s going to come down soon. Big part of our economy is consumption, if consumers decided to consume less it’s hard to change their minds.

b) I think he was thinking that when imported prices are lower (and we do import a lot) you can save a big part of your salary and still spend the rest on local services for instance. But when more of your money goes to pay for imported goods, you have less money left for local services (it’s the tradable / non-tradable inflation story) and that in itself could be a recession trigger, even if the rest and demand stays the same.

yeah, but people know if they have more or less money — there’s plenty of evidence of short run money illusion, and that’s quite apart from the real effects we ought to expect if folks have borrowed and invested / consumed based on an assumed wage / profit growth profile that ends up being too optimistic.

Absolutely, I am just saying that overall “confidence” is the key, and the RBA cutting rates plus a falling AUD is not necessarily a sign of good things coming. This is more consumer psychology rather than economy !! :)

“you think when you sign-up for a 500K mortgage you are thinking of future NGDP growth?” Absolutely! Or at least nominal income/wages growth of me and everyone else.

On imports, you’ve assumed that the income effect outweighs the substitution effect. Maybe that’s the case for petrol, but not for other things. A purely exogenous fall in the dollar must be expansionary. A fall in the dollar due to falling world demand or o/s tightening would be contractionary.

yeah, that’s true. the substitution effect takes time, but is the more medium term boost — i agree. i was just pointing out that the AUD drop has an initial tightening impact on average for consumers, due to the income effect.

Yes, nominal wages … and job security especially. Also confidence that I am not wasting my money into a depreciating asset. All of which has been heavily shaken since the GFC.

Re AUD: not only petrol does not have a substitution in Australia. In the medium term I think you are right, but in the short term a fast falling AUD could be a major shock.

a short term income shock, i agree. the high AUD has been the main thing spreading the boom this cycle.

i strongly agree with your second point — the lower AUD ought to raise the return on capital for the trade exposed sector, but it’s going to sap real consumer wages, and we know that consumer confidence is very sensitive to fuel prices in the short run — so the immediate impact of the lower AUD could be to force rate cuts.

right you are — i’ve corrected … one of the perils of on-screen editing!

Another outstanding post Ricardo…your on fire!

Agree with you ssec, the savings ratio is stubbornly high and doesn’t look like changing. It will be interesting to see if change in the aud changes this?

Yes, it’s going to be interesting (I personally think it will take a few years to heal the GFC scare). BTW the saving rate is high if we compare vs. the credit boom period, but “normal” if we compare to the period before that. If one subscribes to the theory that the credit boom was the result of a one-off event, that is, interest rates and inflation coming down significantly, then one would not see the saving rate come down significantly any time soon.

seems to me that rate cuts are boosting the savings rate as the average person isn’t refinancing their mortgage or changing their repayment schedule — so it just changed the P and I mix (more P repayment) which has the mechanical effect of boosting the savings rate. the ‘spending moment’ will come when the marginal borrower steps up, folks start to lower repayments, or they cash out some of their equity — all of which seem less likely due to the shock of the GFC.

It’s always the same, isn’t it ! :)

Whats interesting about the savings ratio is that it has generally been trending down until it bottomed in 2003. So it has never really been normal.

This article shows why we need a land tax (or Georgism or Geoism or Geonomics or whatever you want to call it) or good chunks of it. The investment % has gone up as the well off in society are using the weak housing price and stupid tax breaks to increase their land holdings. This is tightening their hold (and the hold of their offspring) on future wealth to make sure inequality will always see a widening gap between rich and poor