The Jan 2014 labour market report was BAD.

The unemployment rate rose to 6% — exceeding the GFC peak — as the ranks of unemployed women rose (female employment had been relatively stable).

The share of the population in employment continued to slide: this measure went below the GFC low some time ago. Again, men had been taking the brunt of this downturn (they have a relatively larger share of Manufacturing and Mining, which are both losing jobs), however it’s now broadened to include women as well.

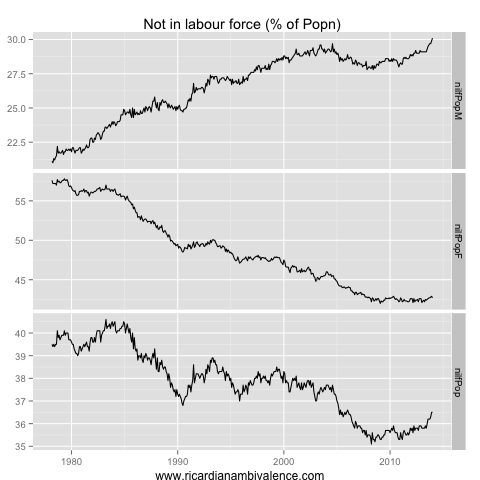

Finally, the proportion of both women and men (especially men) that have exited the labour force continues to trend higher. My guess is that it’s tough to find work, so people are just not looking.

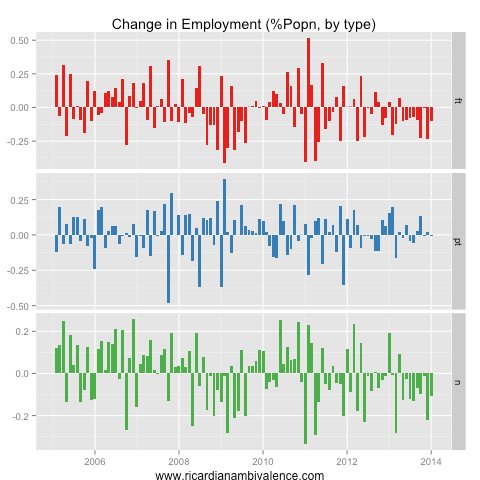

I think the best way to measure the monthly labour market data is to look at how the share of the population is split between employment categories (part time and full time). This gets rid of the ‘inflation’ problem (an issue from the fact the population benchmarks used to inflate the survey are often wrong) that infects the jobs estimate (this is a household survey, not an establishment survey).

On this basis, you can see that the share of the population in employment has been trending down for some time, and in particular that full time employment has been in retreat since 2011 (no coincidence that this is the period in which the RBA has been easing monetary policy).

The good news — to the extent that there is some — is in the hours worked data. Average hours worked per employee have been rising, as total employment has been declining but total hours worked have been rising somewhat.

I am not sure this is such great news … I regard a move back to an easing bias as the RBA’s most likely next step.

Three years of tight money will tend to do that.

I suppose we should be grateful for having the ‘least worst’ central bank around. At least for now. Hopefully Hockey won’t replace Stevo with some hair-chested Austrian crank. When’s his term over?

Oops, I meant hair-shirted. I blame Friday night drinks.

Hi Ricardo, any thoughts on the capex data?

Looks bad. I will do something meaningful on it this weekend.

Hi Ricardo, today’s building approvals release was quite strong, but I wanted to see in terms of value rather than simply numbers.

So I calculated the total value of new *RESIDENTIAL* buildings approved in the last 6 months and that should be 25b in total if my calculations are correct (so annually 50b if it stays the same in the next 6 months). That compares to 20b for 6 months that we had last January. So let’s say cutting rate brought forward an extra 10b for 2014 of new residential investment compared to last year 2013. That’s good, but it’s still only part of the -40b of the capex survey isn’t it? I can’t see where the extra investment will come from, probably not from public spending, and it’s not realistic to think residential construction will double from current levels. We are talking about end of this year, early next year, so no much time for other industries to gear-up even if the dollar falls further… what do you think? Are the economists forecasting rate rises by year end right or wrong? thanks

… and regarding the other number, the “Value of *Non-residential* Building Approved”, how does that number fit with the capex data in terms of being trailing, coincident or leading? That one it’s still kind of steady compare to last year. thanks

That’s right, the increase in resi and non-mining would have to take both to records as a share of gdp to fill the gap. seems unlikely to me. We make a bit back on net exports, but you cannot keep gdp anywhere near 3% unless consumption picks up. That probably means a lower savings rate – which means we consume a wealth effect.

And yes, of course the RBA won’t hike this year – the capex cliff is 14/15, so the consumption upswing is arriving only in the nick of time. Hike rates and you lose the wealth effect and consumption boost, and you have deeply sub trend growth.

thanks i do not see much of a wealth effect, house prices flat basically for the lasr 5 years and shares haven’t regained previius peak either. AUD has fallen which makes most people poorer as does the falling tot. i think the saving rate will not come down for many years and we will get a mini boost during 2014 but not enough and rates will probably need to go down to 2% in 2015. A lot will depend on tha US too if their economy will accellerate a falling AUD will prevent further rate cuts. Shares is the place to invest now IMO companies will be making good profits while rates are this low.

Gerard Minack had an interesting note saying that Aust shares were likely to under-perform during the ongoing fall in the ToT. I would say, sure, if the RBA doesn’t do it’s job!

Agree with Ricardo that it’s difficult to see housing and exports being enough to offset the fall in mining capex over the next year or so. And the only way to get more consumption is easy(ier) policy to boost expected wages and ongoing growth in asset prices. So many clowns are going on about rising asset prices, when, as ssec says, shares are still well off their 2007 nominal peak and house prices are only slightly above their nominal 2010 peak on average and still below it in the smaller capitals. The data for Sydney show that you need to see a 10-15% price increase on the previous peak to see a suitable increase in approvals, let alone actual housing investment. We’re still 10% short in Melbourne and 15% off in Brisbane and Adelaide.

Incumbent state governments new and old are suffering electorally due to weak jobs growth; it’s quite likely that the first-term Victorian Coalition Government will lose in November. That’s pretty rare. The federal government has two years before it will be facing an election itself. Hockey still has time to amend the RBA’s target to incorporate something to do with nominal income. If he doesn’t, the Government’s fate will be far less assured than any first term government’s ought to be. As of yesterday, the RBA was unselfconsciously forecasting a further rise in the UnN rate, despite declining participation. I mean, can’t people see what the problem is here? Or are we Europe, getting side-tracked by one-off and government-influenced increased to the CPI? Wages growth being at multi-decade lows should tell them there are no demand pressures out there.

Hi Rajat, re shares I do not like to invest when assets are already at record high, so I do not buy US or Europe now. I see more potential in Australia with mining profits and low rates. I also like the franked dividends you get from aussie shares. Then I add my usual short AUD to that to double up! :)

What I am not understanding is that we have unemployment already at 6% now when the mining boom is still in full force … and unemployment trailing. So what happens in 2015 when the boon unwinds? Is there anything we can really do to avoid the “bust”? Should the RBA cut rates again even if that would send inflation up above 3%? We should not underestimate what petrol prices can do to an economy…. at one point we may be wishing the dollar never fell!

One other thing I ask myself is: are we giving too much weight to the mining “cliff”? The “boom” never felt like a real boom for most people, will the “bust” really feel like a “bust” at all?

My starting point is the supply side. If I see the labour market slack, slow NGDP growth and slow wage growth, I say monetary policy has been too tight.

I blame the RBA for over-squeezing the rest of the economy over the period late 2010 to late 2013 to ‘make room’ for the mining boom. They went too far; made more room than they needed to. There is/was no reason for our labour market to weaken during the mining boom. That’s why mining boom mark lI didn’t feel like a boom. There’s no reason we can’t feel fantastic as the boom unwinds if the RBA cushions the blow adequately. Because they’ve started so far behind the eight-ball, they will have to over-compensate now. What annoys me though is they face zero accountability for stuffing up. It’s been nearly two years since Stevens’ egregious “Glass half full” speech and things are only just starting to turn around at the outset of the long-awaited capex cliff. If some chump like me can see it, why can’t these MIT and Princeton PhDs see it? Oh, maybe they’re no different from Draghi and Bernanke…

I think a fundamental error was also before the GFC, between 2005 and 2008. They let inflation and asset prices go way too high, the ASX 200 was exploding, so were house prices, the dollar most likely was too low then, rates needed to be much,much higher. Now we want residential construction to replace mining, but affordability is very low and residential prices are starting to be pretty uncompetitive on the world scale too.