The case for the RBA to cut their cash rate at their 7 May meeting has been beaten up by the RBA’s own views on the GDP data, but I still think that the data makes a decent case for an easing.

The rosiest possible assessment of the data is that growth has slowed to trend. Indeed, that’s the position i think Deputy Gov Debelle took in his speech, The State of the Economy.

Trend growth isn’t going to get the job done, as you need above trend growth to push down the unemployment rate and drive up wages and inflation over time.

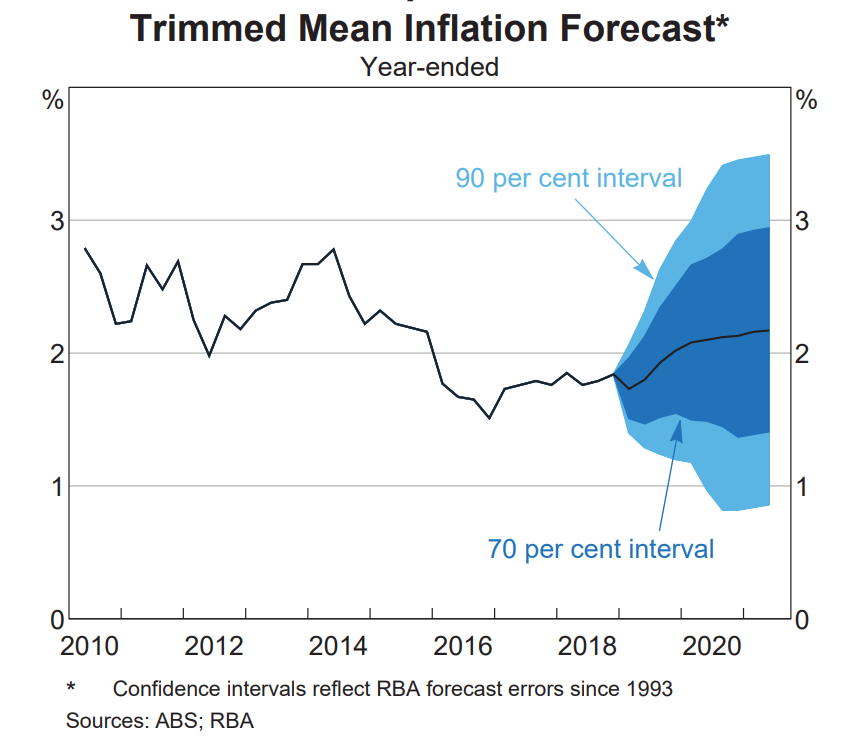

So ultimately, the question is: does RBA Gov Lowe care about hitting his 2.5% inflation target? The chunky GDP downgrade that has to be put into the May SOMP means that the inflation forecast must come down a little over the projections (they linked the slower growth profile with a lower core CPI track in their Feb SOMP, so this part of their inflation model still works).

A weaker starting point would be inconvenient.

The last seven trimmed mean CPI prints have all rounded to 1.8%y/y. I think that’s very unlikely to remain true after today’s CPI print. The 0.6%q/q Q1’18 trimmed mean print will drop out of the base today, and I expect that it’ll be replaced with 0.4%q/q print (0.4%q/q is the average for H2’18). The RBA are expecting a high 0.4x%q/q print (rounding up to 0.5%q/q) which would take deliver ~1.75%

A 0.4%q/q result for trimmed mean CPI will take through-the-year core CPI down ~20bps, to ~1.67%y/y (from 1.84%y/y). That’s uncomfortable, but perhaps they’ll tough it out.

A 0.3%q/q trimmed mean CPI result would be a BIG problem for the RBA — as both inflation and growth will have clearly decelerated over the past year. Based on these starting points, I just don’t see how Gov Lowe could present his board with a credible case that inflation is going back to 2.5% in a relevant period with that starting point.

The RBA’s main job is to make headline inflation average 2.5% over time. The prior two RBA governors have hit their 2.5% target exactly. Given that today is likely to produce a 0 print for headline CPI (headline CPI will slow ~50bps to 1.3%y/y), Gov Lowe seems to have little hope of doing so in his current 7 year term.

Gov Lowe’s contribution to Australian Monetary policy has been the emphasis of financial stability — but with house prices continuing to fall, i don’t see how that’s a barrier to cutting the cash rate.

There is no way the RBA wil cut only a few days before an election when they are just not sure.

It is the lay down misere’ of 2007

I like 500

I should have said it is NOT the lay down misere’ of 2007.

sorry about that chief

Looks like it is done